Lido Insights

Gift Giving Strategies: Charitable Lead or Charitable Remainder Trust?

A fully integrated charitable giving strategy that aligns your tax, estate, and financial planning objectives has the potential to maximize the impact of your gift while delivering significant benefits for your family. At the heart of your strategy is choosing the trust type that best meets your objectives.

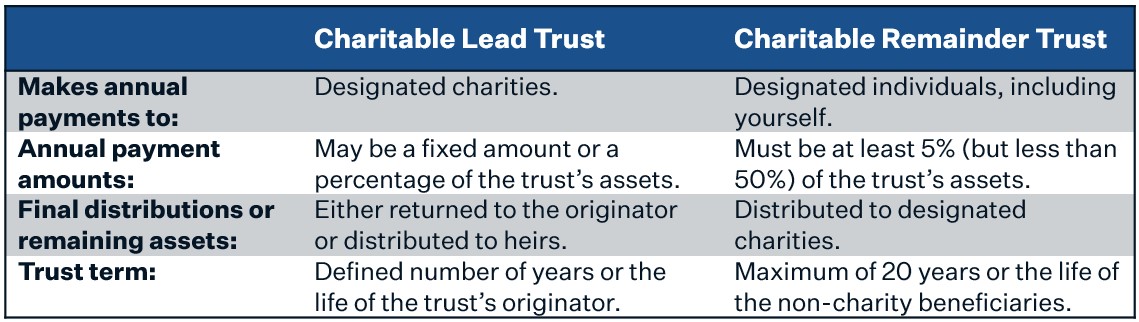

Two of the most common are Charitable Lead and Charitable Remainer Trusts. Both are funded by your donation of cash, publicly traded securities, or a wide range of other assets. Both make annual payments to designated beneficiaries. And both are established for a defined term, after which the remaining assets are distributed.

Despite these common elements and similar sounding names, Charitable Lead and Charitable Remainder Trusts have significant differences, particularly in potential tax treatment. What follows is only intended to help familiarize you with some of the key features and potential benefits you may wish to consider. Keep in mind that trusts are complex. You should review your options carefully with your tax and legal professionals.

Let’s begin by noting a few key differences:

Charitable Lead Trust: Combine Giving and Wealth Transfer

Wealthy individuals, family offices, and tax professionals have used Charitable Lead Trusts for a range of purposes. Here are three potential benefits you may wish to discuss with your tax and estate teams:

Giving impact: Instead of making a one-time donation, establishing a trust can spread your charitable support over many years.

Current year tax deduction: If you choose grantor status, you have the option to take an immediate income tax deduction based on the present value of future charitable distributions (IRS limits and conditions apply), which may be attractive for individuals exploring strategies for reducing the tax impact of windfall income.

Wealth transfer: You will not be able to claim an immediate income tax deduction if you choose non-grantor status. However, the trust is considered the owner of the assets and may be able to claim unlimited tax deductions against its investment income, which potentially supports an efficient wealth transfer strategy.

It’s important to work with your tax and estate professionals to determine whether grantor or non-grantor status makes sense for you.

Charitable Remainder Trust: Income and Charitable Behests

The potential benefits of a Charitable Remainder Trust may include a combination of tax relief, income stream, and a charitable behest. Once again, you should work with a tax professional to explore whether it makes sense for you.

Create an income stream: A remainder trust may be used to create an income stream for yourself (e.g., for retirement) or as support for other individuals.

Tax treatment: There are several potential benefits to consider from a tax standpoint, including:

- You may be able to take an immediate charitable deduction based on the expected value of the charitable behest at the end of the term. (Within IRS limits.)

- The Trust is considered the owner of the assets and is exempt from potential investment income taxes, including capital gains tax from liquidating highly appreciated assets.

Giving strategy: At the expiration of the trust’s term, the balance of your non-revocable contribution is distributed to your designated charities.

This short summary cannot capture the complexity of charitable trusts as a tool with in giving or tax strategy. An assessment of their potential suitability for your situation and objectives should be made with guidance from tax, trust, and wealth management professionals deeply familiar with your financial situation.

Holistic, Integrated Wealth Management

Philanthropy and charitable giving are their own reward. But a well-planned giving strategy created with a holistic understanding of your objectives, tax situation, wealth transfer, and other life aspirations can amplify the power of your giving and create tangible financial benefits for you and your family.

Lido can help. Our family office style approach can bring trust, tax, financial planning, and investment expertise together to help you create a gift giving strategy that meets your needs and objectives.